The Internal Revenue Service (IRS) revises income-reporting Form 1040 and asks the taxpayers an additional question regarding virtual currency. New version of schedule 1 form 1040 (downloads as a PDF) is issued by the Internal Revenue Service that will be applicable from the next taxation season in USA. The addition of new Cryptocurrency question asks the details that whether the taxpayer has received, sold, exchanged or acquired any type of cryptocurrencies or not. Some of the examples of cryptocurrencies include Ether, Bitcoin, Roblox, V-bucks, etc. the new question on the early release draft of the Form 1040 will definitely reveal the financial interest of taxpayers in the virtual currency.

The new question in Form 1040 is:

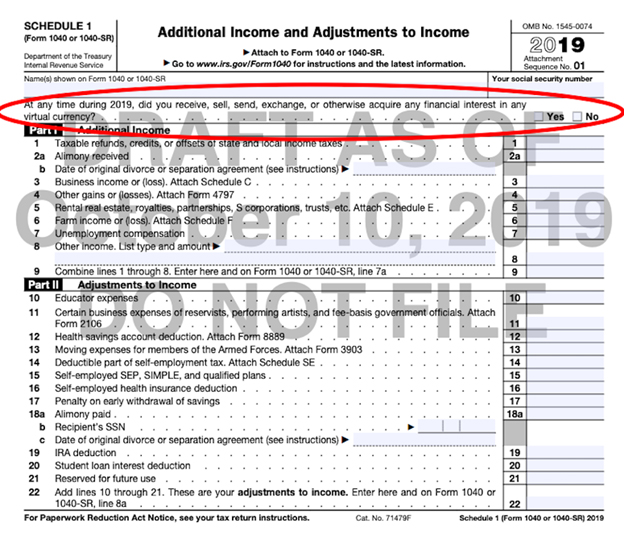

At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?

Must note that the new question has been added to the Schedule 1 of the Form 1040 right on the top section. Schedule 1 is used for the reporting of income as well as any adjustments to the income that cannot be entered directly on the front page of the Form 1040, as depicted in the given screenshot of the draft of the new Form 1040, Schedule 1, Additional Income and Adjustments to Income:

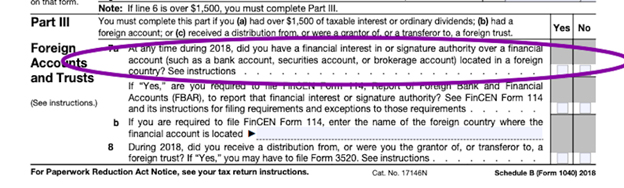

If the wording of the question sounds familiar to you then you are right, as somewhat similar wording can be seen on the schedule B, Part III that asks about the offshore accounts. We also provide Form 1040 filing service in United States to our clients. See the question right at the bottom of the schedule that is also depicted in the given screenshot:

At any time during 2018, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign country?

Furthermore, the IRS also notified the taxpayers via email that those specific taxpayers who file Schedule 1 for the reporting of income or for making adjustments to the income should check the appropriate box regarding virtual currency as anything cannot be entered directly on Form 1040. If the answer is ‘NO’ about virtual currency question in Schedule 1 of Form 1040, then filing Schedule 1 is not necessary for those taxpayers for some other purpose. The instructions for related draft Form 1040 are also available on the IRS website that helps the taxpayers regarding filing of form and other related questions. The IRS provides additional supports to the taxpayers in the form of acceptance of comments on the new draft Schedule 1 Form 1040 via email at WI.1040.Comments@IRS.gov for a 30 days comment period which is beginning from 11th October, 2019. It is understood that the answer to each question may not be provided by the IRS, but your feedback will definitely be considered by the government legislation.

You can also check our post regarding IRS new guidance & FAQs regarding virtual currency taxation & obligations in USA. What do you thinks about the IRS strategy line-up regarding virtual currency detailing in the Form 1040? Let us know regarding your valuable feedback in the comments section!